Credit 101

What is a Credit Score?

Most lenders rely on a mathematical formula to generate a score to determine if an individual is a good credit risk. The most frequently used version is the FICO® Score created by Fair Isaac and Company. A FICO® Score is a snapshot of your credit risk picture at a particular point in time. FICO® Scores range between 300 and 850, with higher values indicating a lower risk to lenders.

FICO® Scores are the most common credit score used by 90% of top lenders to decide credit approvals, terms, and interest rates. It is likely, when you apply for a mortgage, an auto loan, credit card, a new line of credit, or a bank loan, the lender is looking at your FICO Score.

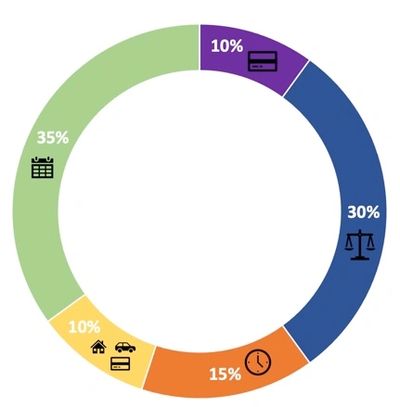

FICO® Score Components

Payment History 35% of your FICO® Score is based on your payment history

Outstanding Debt 30% of your FICO® Score is based on your outstanding debt

Length of Credit 15% of your FICO® Score is based on how long you've had credit

Pursuit of New Credit 10% of your FICO® Score is based on recent inquiries and recently opened accounts

Types of Credit Used 10% of your FICO® Score is based on the different types of credit you have

CREDIT FICO SCORE RANGES AND THEIR MEANING

800 and Higher (Excellent) With a credit score in this range, no lender will ever disapprove of your loan application. Additionally, the APR (Annual Percentage Rate) on your credit cards will be the lowest possible. You’ll be treated like royalty. Achieving this excellent credit rating requires not only financial knowledge and discipline and but also good credit history. Generally speaking, to achieve this superb rating, you must also use a substantial amount of credit on an ongoing monthly basis and always repay it ahead of time.

700 – 799 (Very Good) 27% of the United States population belongs to this credit score range. With this credit score range, you will enjoy reasonable rates and be approved for nearly any type of credit loan or personal loan, whether unsecured or secured.

680 – 699 (Good) This range is the average credit score. In this range, approvals are practically guaranteed, but the interest rates might be marginally higher. If you’re thinking about a long term loan such as a mortgage, try working to increase your credit score higher than 720, and you will be rewarded for your efforts – your long term savings will be noticeable.

620 -679 (OK or Fair) Depending on what kind of loan or credit you are applying for and your credit history, you might find that the quoted rates aren’t the best. That doesn’t mean that you won’t be approved but, certain restrictions will apply to the loan’s terms.

580 – 619 (Poor) With a low credit rating, you can still get an unsecured personal loan and even a mortgage, but the terms and interest rates won’t be very appealing. You’ll be required to pay more over a more extended period because of the high-interest rates.

500 – 579 (Bad) With a score in this range, you can get a loan but nothing even close to what you expect it to be. Some people with bad credit apply for loans to consolidate debt in search of a fresh start. However, if you decide to do that, then proceed cautiously. With a 500 credit score, you need to make sure that you don’t default on payments, or you’ll be making your situation worse and might head towards bankruptcy, which is not what you want.

499 and Lower (Very Bad) If this is your score range, you need serious and professional assistance with handling your credit. You’re making too many credit blunders, and they will only get worse if you don’t take positive action. If you are thinking of a loan, keep in mind that if you find a sub-prime lender (which won’t be easy), the rates will be very high, and the terms will be stringent. We recommend that you fix your credit and only then move on to applying for a loan.

Learn More

Credit Bullseye LLC® will provide you with a complete overview and understanding of what’s on your credit report, and give you feedback on ways to improve your credit score and credit worthiness.

Steps to take to improve your credit score

- Pay your existing bills on time

- Use your credit cards regularly, but pay the balances off in full to show credit responsibility. If you cannot pay the balances off in full each month, reduce utilization to less than 30%

- Limit your credit applications and inquiries made to your credit report

- Keep accounts opened and do not close them out

- Limit how much you charge on your credit cards (keep your balances at 30% or less of the credit limit). Keep in mind that lower limit cards can quickly go beyond a 30% utilization if used regularly

- Apply for a secured credit card if you have no credit

Credit Bullseye LLC®

Fishers, Indiana, United States

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.